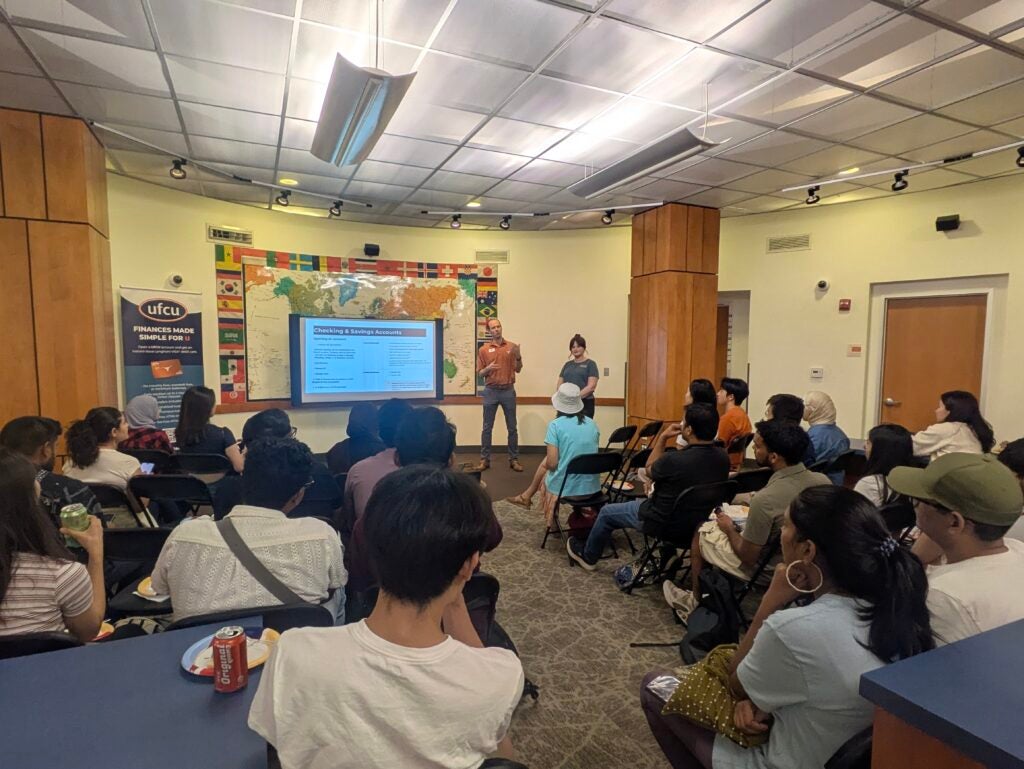

Earlier this month, we hosted the opening session of the Fall 2025 Financial Wellness Lunch series in partnership with the University Federal Credit Union (UFCU), as part of our Wellness Fridays programming.

More than 30 students attended this introductory session, which focused on initial steps international students and scholars can take to feel more confident navigating the U.S. financial system. The presenters also introduced topics that will be explored in more depth at upcoming meetings of this series.

The presentation was led by Olivia Hayden, manager of financial success at UFCU, together with David Kies, manager of UFCU’s Guadalupe Branch, where the seminar was hosted. Together, they offered practical guidance on everyday financial essentials. Other highlights included the spread of sandwiches, Sweetgreen bowls, and snacks for attendees to enjoy in addition to UFCU merch to take home with them!

Checking and Savings Accounts

Students learned how to open checking and savings accounts, the documents required to get started, and tips for choosing the right financial institution.

Accounts can be opened at any UFCU branch location, and students who do not have an SSN can open a Savings, Checking, Simply U, or Business Account by providing the following documents:

- Photo Identification (Passports or student visas are acceptable)

- Field of Membership Acceptance Letter (Student ID also acceptable)

- W-8 BEN Form (Provided by UFCU and also available at Texas Global front desk)

All About the ITIN

The presentation also included an overview of the Individual Taxpayer Identification Number (ITIN), explaining who needs one, how to apply, and how it can be used to access services such as renting an apartment, building credit, or applying for loans—a common area of concern for newly arrived international students.

For more information on what ITINs are used for, who needs one, and how to apply, visit the Individual Taxpayer Identification Numbers (ITIN) page on the Texas Global website.

Credit in the U.S.

One of the highlights of the opening session was a sneak peek at the central topic of the second session in this series: the personal credit score system in the U.S. Hayden and Kies broke down how credit scores are calculated, why they are important, and what steps newcomers can take to start building a strong credit history.

Credit lets you borrow money now and pay it back later. Lenders decide whether and how to extend credit based on your history and obligations. Your credit score, which is a three-digit number from your credit report, shows how likely you are to repay. It’s mostly based on payment history (35%) and amounts owed (30%), followed by length of history (15%), new credit (10%), and credit mix (10%).

Pay bills on time, keep balances low, and avoid closing old accounts to build a strong score.

Borrowing Money

Hayden and Kies also touched on the connection between credit and the subject of session three: spending. Attendees explored the basics of borrowing money, including the differences between credit cards, personal loans, auto loans, and mortgages, as well as how interest rates affect repayment.

In the U.S., borrowing typically means either revolving credit (credit cards) or installment loans (personal, auto, or home loans). All loans have interest rates that depend on your credit profile and the type of credit. Compare offers and read terms carefully before applying.

ITIN holders can start building credit by opening bank accounts, applying for eligible products, and using them responsibly by paying on time, keeping balances low, and avoiding excessive debt.

If you have specific questions about credit, opening accounts, or anything else related to banking and personal finance in the U.S., don’t hesitate to reach out to our friends at UFCU! There are many locations all over Austin, including two convenient campus locations:

- University Branch next to the University Co-op on Guadalupe Street

- Gregory Gym Branch inside Gregory Gymnasium on Speedway

Fall 2025 UFCU-ISSS Financial Wellness Series

Interested in learning more about personal finances in the U.S.? Register to attend our upcoming Financial Wellness sessions.

Session 2: Understanding Your Credit Score and How to Improve It

October 3, 2025, 12-1 p.m., at UFCU University Branch

Gain valuable insights into how credit scores work, learn strategies to improve your score, and discover how it impacts your financial health.

Session 3: Money Mindset: Psychology of Spending and Making Better Financial Decisions

November 7, 2025, 12-1 p.m., at UFCU University Branch

This seminar delves into the behavioral aspects of money management, helping participants understand their spending habits and impulses by learning how psychological factors influence financial decisions, such as impulse buying, emotional spending, and the impact of advertising.

Session 4: Introduction to Financial Planning and Investing with Interactive Cashy Game

December 5, 2025 at UFCU University Branch

Cashy is an app that provides tools to master the essential skills for saving, planning, borrowing, and spending wisely through gamification: compete with friends, grow your assets, and learn money management skills in a fun, engaging way.

About Wellness Fridays

This seminar was part of our Wellness Fridays series, an ongoing program designed to support the overall well-being of international students and scholars at UT Austin. Wellness Fridays feature a mix of activities, including art walks, social cycling and social hiking events that encourage connection and physical activity, as well as co-curricular programs offered in partnership with Counseling and Mental Health Center, University Housing and Dining, and community partners like UFCU, which create space for students to share, learn, and reflect together.

This blog post was contributed by Ken Sears, Customer Service Coordinator on the Intercultural Programs & Initiatives team at ISSS.

Leave a Reply