Who is a Nonresident Alien for Tax Purposes? Generally, students who have been in the U.S. for five years or less as of 2013 and scholars who have been in the U.S. for two years or less as of 2013 are nonresident aliens for tax purposes. If you are uncertain… read more

Volunteer Income Tax Assistance

Filing Taxes as a Resident Alien

Who is a Resident Alien? As a general guideline, students who have been in the US for longer than 5 years and scholars who have been in the US for longer than 2 years are resident aliens for tax purposes. If you have questions about your particular situation, you can… read more

Nonresident Tax Filing Help is Now Available

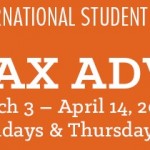

What Tax Resources are Available for Nonresident Aliens? ISSS has purchased GLACIER Tax Prep to help students and scholars – who are nonresident aliens for tax purposes – file taxes. We also offer VITA volunteer tax advising on Monday and Thursday evenings for nonresident aliens who need assistance with GLACIER… read more