With the tax season upon us, it can be confusing to know what your filing responsibilities are for the year. Here are some helpful questions and answers for international students and scholars regarding the form 8843. Do all nonresident aliens need to file a tax return? Not all nonresident alien… read more

nonresident alien taxes

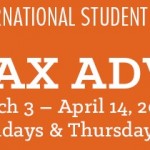

Nonresident Alien Tax Filing Services through ISSS are Now Available

Who is a Nonresident Alien for Tax Purposes? Generally, students who have been in the U.S. for five years or less as of 2013 and scholars who have been in the U.S. for two years or less as of 2013 are nonresident aliens for tax purposes. If you are uncertain… read more

Tax Tips for the Upcoming 2013 Tax Season

If you’re leaving The University of Texas at Austin or the US permanently after the fall 2013 semester, you might be curious about what tax steps you should complete now, before you leave. Here are a few pointers to prepare for tax season: Only students and scholars who received US-sourced… read more

ITIN Application Filing Help is Available through ISSS

If you are receiving a US-sourced scholarship or fellowship and are not eligible for a social security number (SSN), you should make an appointment with the tax advisor to apply for an individual tax identification number (ITIN). An ITIN is needed to help facilitate the payment of scholarships or fellowships… read more