The International Office has seen an increase in reports from students regarding tax scams during these summer months. In response to this increase, we would like to repost this helpful guide on what to do if you are contacted by a tax scammer. International students at UT and other universities… read more

tax

Scam Alert: Scams Targeting UT Austin International Students

International students at UT and other universities across the U.S. have frequently been targets of a variety of scams. The scammer will identify themselves as a police officer, government official, or university official and threaten dismissal from the university, deportation from the U.S., or dropped classes unless the student immediately… read more

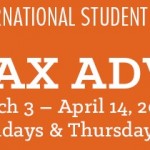

Nonresident Alien Tax Filing Services through ISSS are Now Available

Who is a Nonresident Alien for Tax Purposes? Generally, students who have been in the U.S. for five years or less as of 2013 and scholars who have been in the U.S. for two years or less as of 2013 are nonresident aliens for tax purposes. If you are uncertain… read more

Tax Information for Resident Aliens for Tax Purposes

Who is a Resident Alien for Tax Purposes? Generally, students who have been in the US for longer than 5 years and scholars who have been in the US for longer than 2 years are resident aliens for tax purposes. If you have questions about your particular situation, you can… read more

Tax Tips for the Upcoming 2013 Tax Season

If you’re leaving The University of Texas at Austin or the US permanently after the fall 2013 semester, you might be curious about what tax steps you should complete now, before you leave. Here are a few pointers to prepare for tax season: Only students and scholars who received US-sourced… read more

ITIN Application Filing Help is Available through ISSS

If you are receiving a US-sourced scholarship or fellowship and are not eligible for a social security number (SSN), you should make an appointment with the tax advisor to apply for an individual tax identification number (ITIN). An ITIN is needed to help facilitate the payment of scholarships or fellowships… read more

IRS Phishing Scam

Phishing scams that ask for wire transfers, bank account information and SSN/ITIN numbers are a common occurrence on the internet. Recently there has been a phishing scam email targeting international students and preying on their misinformation about tax refunds. Please keep in mind: The IRS does not email tax payers.… read more

Stay Informed: Scams Affecting International Students & Scholars

International students and scholars should know about scam immigration phone calls that have been reported by universities across the U.S. Here is a specific situation that occurred recently: An international student in New York City received a phone call from someone claiming to be from U.S. Citizenship and Immigration Services… read more