The Capital Metropolitan Transportation Authority, or Capital Metro, provides public transportation in Austin. On their website, you can find bus schedules, fare prices, and tips for using their services. In case you didn’t know, there is no cost for any international student or scholar with a valid UT Austin ID… read more

General

What is Considered “Employment”?

As an F-1 or a J-1 student you are pretty limited in your ability to work during your studies. The student visa is intended for study and not employment. But what is considered employment in the US? And how can you make sure that you do not break the rules… read more

Beware of IRS and Tax Scams

Please be wary of any phone calls or emails that you may receive from the Internal Revenue Service (IRS) regarding your tax situation, especially at this time of the year. International students and scholars are often targeted by anonymous individuals alleging to be individuals working for the IRS, or government… read more

Travel Reminders

Spring break is right around the corner. If you are traveling internationally, you will need a valid travel signature on your I-20 or DS-2019 in order to re-enter the United States. The travel signature can be found on page 2 of the I-20 and on page 1 (bottom, right corner)… read more

Lawyer Referral Service – State Bar of Texas

Did you know that the State Bar of Texas* has a useful resource called the Lawyer Referral & Information Service (LRIS)? If you are not sure how to go about finding a lawyer, the LRIS may be a good place to start. After you provide some basic information about your… read more

GLACIER Tax Prep (GTP) Available

Tax season is well underway and the International Student and Scholar Services is here to help! The International Office is offering free tax filing assistance for students and scholars who are classified as Nonresident Aliens for Tax Purposes via GLACIER Tax Prep (GTP). Filing your U.S. tax documents is easier… read more

Filing Taxes as a Resident Alien

Who is a Resident Alien? As a general guideline, students who have been in the U.S. for longer than 5 years and scholars who have been in the U.S. for longer than 2 years are resident aliens for tax purposes. If you have questions about your particular situation, you can… read more

GPT Mexico 2019

The Global Professional Training (GPT) for Mexico returns to campus March 30th! This conference focuses on professional development, intercultural training & networking opportunities for international students from the area, as well as those who are interested in studying, working, or living in Mexico. This 1 day conference features plenary speakers,… read more

Tax Form 8843 for Nonresident Aliens

With the tax season upon us, it can be confusing to know what your filing responsibilities are for the year. Here are some helpful questions and answers for international students and scholars regarding the form 8843. Do all nonresident aliens need to file a tax return? Not all nonresident alien… read more

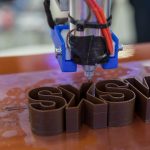

SXSW 2019 in Austin, March 8-17

Like so many things in Austin, the two-weekend event, South by Southwest, goes by many names. It is usually written as SXSW and is often shortened to “South by” in conversation. Since the first SXSW event in March of 1987, SXSW has grown into the SXSW Conference & Festivals that… read more